WWE's Executive Vice President Kevin Dunn has made a lot of money over the last couple of months, selling off more than $10 million of his WWE stock.

Despite everything that is going on around them right now, some fans, and even some within the business itself, continue to argue that professional wrestling is in a bad place. If anything, the industry is in a better position today than it ever has been before, or at least since the height of the Monday night war two decades ago.

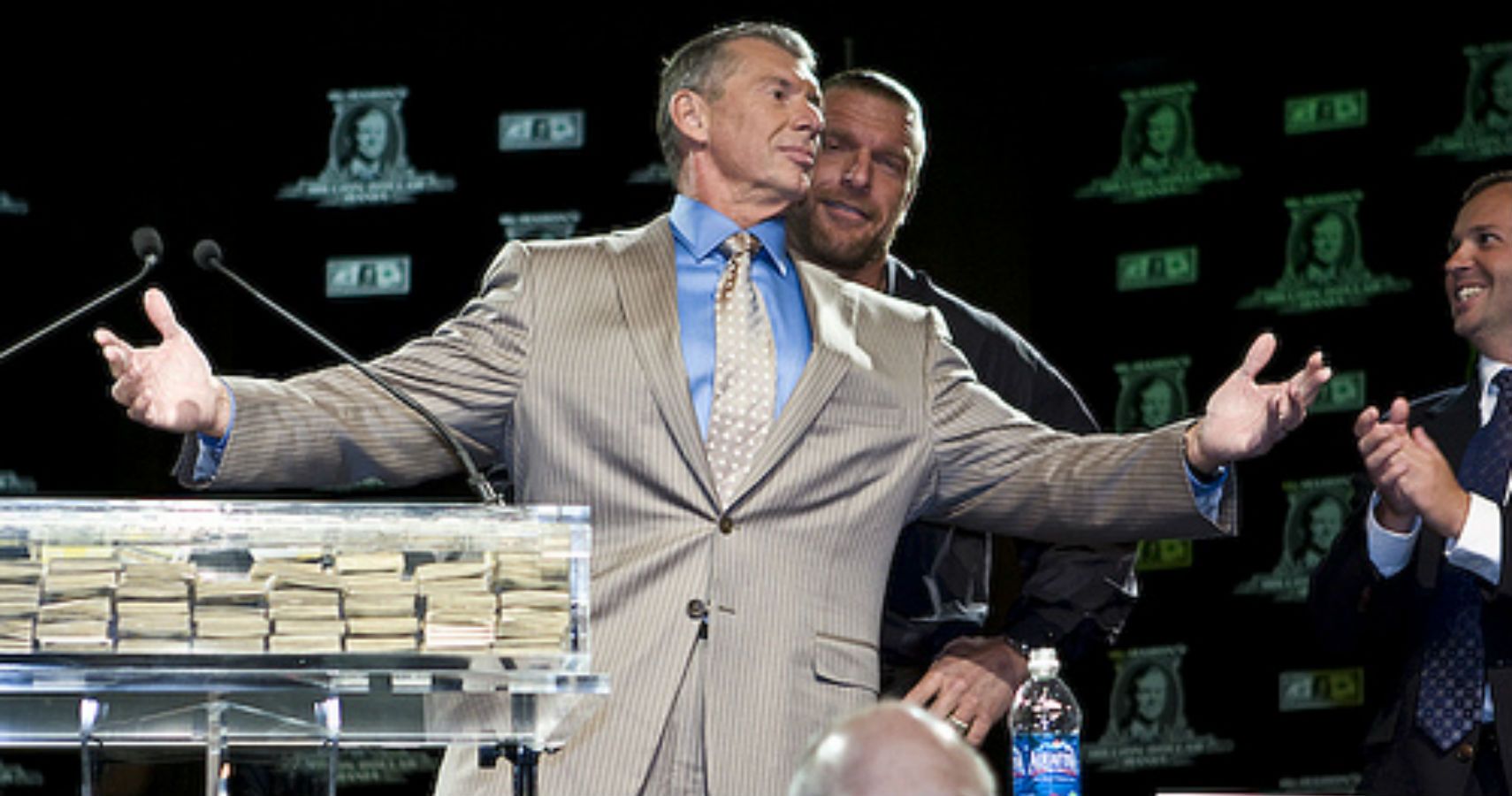

What many of current day pro wrestling's critics focus on is WWE's product, but even if you don't like it the money the company is currently raking in means it won't be changing any time soon. It is clearly doing something right as Vince McMahon's company is currently thriving, signing billion dollar TV deals and being paid who knows what to bring his traveling circus to Saudi Arabia twice a year.

RELATED: THE ISSUE VINCE MCMAHON HAD WITH TAZ WHEN HE FIRST SIGNED HIM TO WWE

One man who appears to be cashing in on WWE's current high is the company's Executive Vice President, Kevin Dunn. According to Fairfield Current, Dunn sold 100,000 of his WWE shares at $79.18 per share on July 30 of this year. On top of that, last Thursday the EVP sold a further 25,000 shares, this time at $86.87 each. That means in less than two months, Dunn has made an impressive $10,089,750 from selling his WWE stock.

Dunn selling off his stock like this has got many wondering whether his long stay with WWE is coming to an end. The producer was first hired by the company all the way back in 1984 and is basically one of the most powerful people in WWE today, despite him never appearing on TV. It is common knowledge that he is Mr. McMahon's right-hand man. Perhaps he is cashing in while WWE's stock is up before the chairman eventually steps down.

The sky-rocketing price of WWE's stock is pretty remarkable. For the past few years, the company's stock has been priced at somewhere between $15 and $20 per share. However, this year it has soared to as high as almost $92 per share. Anyone who has kept hold of their stock must be laughing right now, and who can blame Dunn for cashing in while the getting is good?

NEXT: KURT ANGLE'S INNOVATIVE IDEA TO SAVE THE CRUISERWEIGHT DIVISION